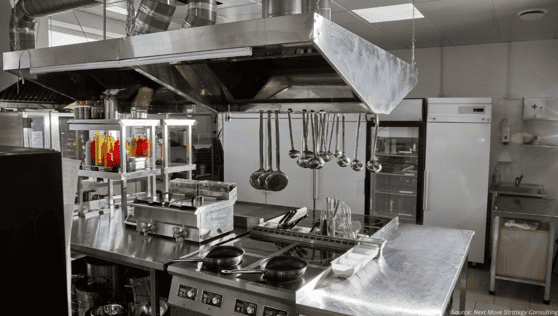

The commercial kitchen appliances sector continues to evolve rapidly, driven by digital platforms and smart technologies that address longstanding challenges in procurement and operations. As foodservice operators worldwide grapple with rising costs and efficiency demands, recent launches signal a shift toward more accessible, innovative solutions. This article examines key trends shaping the sector in 2024–2025.

What Are the Latest Developments in the Commercial Kitchen Appliances Market (2024–2025)?

The past year has seen targeted innovations aimed at streamlining equipment sourcing and enhancing cooking efficiency. As per the recent research study by Next Move Strategy Consulting, the global Commercial Kitchen Appliances Market size is expected to be valued at USD 108.1 billion by the end of 2025. The industry is projected to grow, hitting USD 146.2 billion by 2030, with a CAGR of 6% between 2025 and 2030.

In September 2025, Bistrorun.com launched as a global digital marketplace connecting food businesses directly with manufacturers of commercial-grade appliances, such as ice makers, coffee machines, mixers, ovens, and refrigeration units. This platform emphasizes transparent pricing, quality control, and logistics for bulky items, targeting a frictionless buying experience for professional buyers.

Earlier in March 2025, On2Cook showcased its patented 6-in-1 smart cooking device at the AAHAR international food and hospitality fair in New Delhi. The device, which combines microwaves and induction for hands-free cooking, reduces preparation times by up to one-third and energy costs by at least 40%, while preserving nutrients in dishes like chicken curry (cooked in 7 minutes) and pizzas (baked in 3 minutes). These developments highlight a broader push toward tech-enabled appliances that minimize labor churn and ingredient waste.

These launches are already influencing market dynamics by introducing scalable solutions for high-volume operations. For procurement professionals, Bistrorun’s direct manufacturer partnerships could lower acquisition costs by 20–30% through eliminated intermediaries, based on industry benchmarks for digital marketplaces. Meanwhile, On2Cook’s adoption in over 50 brands, including WOW Momos and Salad Days, demonstrates tangible ROI through reduced operational expenses, potentially reshaping equipment investment decisions for cloud kitchens and restaurant chains.

How Do Applications Span Across Industries in the Commercial Kitchen Appliances Market?

Commercial kitchen appliances serve diverse sectors, from quick-service eateries to large-scale hospitality operations. Restaurants and cafés rely on versatile tools like mixers and ovens for daily production, while hotels demand durable refrigeration units compliant with health standards. Cloud kitchens and food chains, facing space constraints and high turnover, benefit from compact, multi-functional devices that handle steaming, grilling, and baking without extensive ventilation.

Bistrorun caters to these needs by offering curated selections for new bakery openings or high-volume upgrades, ensuring compliance with restaurant standards. On2Cook addresses similar applications in eatery chains, where its automated features tackle 300% labor churn rates and resource wastage, enabling consistent output across multiple outlets. Procurement teams in these industries can leverage such appliances to optimize workflows, with On2Cook’s nutrient preservation appealing to health-focused menus in wellness-oriented cafés.

| Industry | Key Appliance Applications | Benefits from Recent Innovations |

| Restaurants & Cafés | Mixers, coffee machines, ovens | Transparent sourcing via Bistrorun reduces complexity; faster cooking with On2Cook cuts prep time. |

| Hotels & Hospitality | Refrigeration units, ice makers | Global logistics from Bistrorun ensure reliable delivery; energy savings from On2Cook lower utility bills. |

| Cloud Kitchens & Chains | Multi-functional cookers, grills | Hands-free operation minimizes waste; adoption in 50+ brands proves scalability. |

Which Regions Dominate and Grow Fastest in the Commercial Kitchen Appliances Market?

North America holds a dominant position, driven by mature foodservice infrastructure and demand for efficient procurement. The United States and Canada lead due to Bistrorun’s strategic focus on these markets, where streamlined logistics address the challenges of sourcing bulky equipment for urban kitchens.

With over 1 million restaurants in the U.S. alone requiring regular upgrades, the platform’s U.S.-centric launch in September 2025 enhances accessibility, supported by dedicated support for international buyers. This dominance stems from robust e-commerce adoption, with North American food businesses increasingly favoring digital platforms for 15–20% cost reductions.

Asia-Pacific emerges as the fastest-growing region, propelled by innovation hubs and expanding hospitality sectors. India tops this growth, as evidenced by On2Cook’s prominence at AAHAR 2025, where it attracted interest from restaurant owners and hoteliers. The device’s 12 worldwide patents, including in India, and its valuation at 200 crore for On2cook India Pvt. Ltd. underscore local R&D strength. India’s foodservice market, projected to add 10 million jobs by 2025, fuels demand for cost-plugging tech amid urbanization and chain expansions.

Who Are the Key Players and Their Recent Strategies in the Commercial Kitchen Appliances Market?

Leading players maintain scale through established networks, but emerging innovators like Bistrorun and On2Cook are disrupting with targeted strategies. Bistrorun, an emerging B2C platform, launched in September 2025 with direct manufacturer partnerships to offer commercial-grade quality at competitive prices. Its strategy emphasizes expert support and modern interfaces. This approach targets procurement efficiency, with features like clear warranties aiding high-stakes purchases.

On2Cook, another rising contender, focuses on AI-driven innovation, debuting enhancements at AAHAR 2025 to showcase its stirrer-integrated lid and automated water addition. Present in over 50 brands, the company’s strategy involves live demos to drive adoption. This positions it against labor-intensive setups, with energy savings directly tying to profitability.

Traditional leaders like Electrolux or Middleby could integrate such models, but these newcomers exemplify agile deals—Bistrorun’s global logistics partnerships and On2Cook’s patent expansions—that prioritize user-centric upgrades.

What Lie the Future Prospects for the Commercial Kitchen Appliances Market?

Looking ahead, the market points toward hybrid digital-physical ecosystems that blend sourcing ease with smart automation. Bistrorun’s model foreshadows widespread adoption of AI-curated catalogs, potentially expanding to VR previews for equipment fit in space-limited kitchens. On2Cook exemplifies prospects for nutrient-focused appliances, with hands-free tech enabling 24/7 cloud operations and reducing downtime by 25%.

For procurement professionals, future buys might emphasize modular designs, as seen in On2Cook’s 6-in-1 versatility, allowing scalability from pop-ups to chains. Examples include upgrading a café’s setup with Bistrorun-sourced ovens paired with On2Cook for 40% energy cuts, yielding quicker ROI. As sustainability pressures mount, these innovations promise resilient supply chains, with Asia-Pacific’s growth accelerating global standards.

About the Author

Sneha Chakraborty, a skilled SEO Executive and Content Writer with over 4 years in digital marketing, excels in boosting online visibility and engagement with data-driven strategies and compelling content. Passionate about simplifying digital ideas, she enjoys reading, sketching, and nature photography.