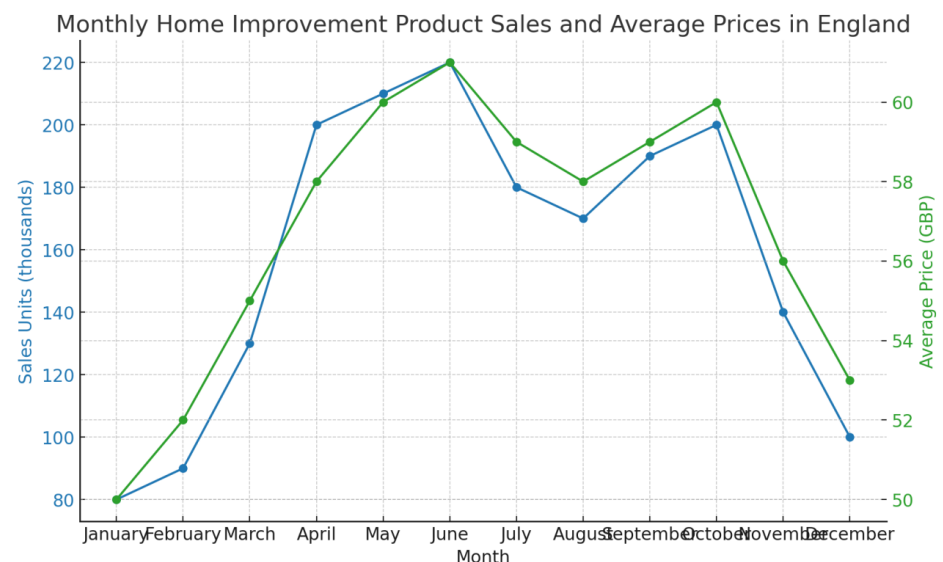

In England, the purchase of home improvement products tends to fluctuate throughout the year, with distinct peaks during certain months. Generally, the spring and summer months, particularly from March to June, see the highest sales volumes.

This period aligns with better weather, which is conducive to both indoor and outdoor renovation projects. During these months, there is a significant uptick in sales of items like paint, gardening supplies, and outdoor furniture, as homeowners prepare their spaces for the warmer months.

Home improvement spending also tends to increase in the autumn, especially in September and October, as homeowners focus on preparing their homes for the colder months. This includes insulation projects, window replacements, and other energy-efficient upgrades. Conversely, sales typically dip during the winter months, particularly in January and February, when fewer people are undertaking significant home improvement projects due to the colder weather.

January & February is the slowest months for the e-commerce businesses. This is in part due to a large amount of consumers spending their allocated budget during holiday sales. JAN & FEB can be a good time to consider buying products on a weekly payment basis.

General trends consumer spending, online shopping, and payment methods. Shift toward Pay Weekly Flooring options. As the cost of living continues to rise, more consumers are expected to shift towards flexible payment options.

Online shopping is projected to continue growing, with more consumers favoring convenience and flexibility. With economic pressures, consumers are likely to prioritize budget management, leading to a higher adoption of installment payment options.

Market is likely to expand significantly, offering new opportunities for retailers and financial service providers. Flexibility and financial management will become critical factors in purchasing decisions, pushing retailers to offer more payment options. As these payment options grow, there may be increased regulatory scrutiny to protect consumers from potential financial risks.

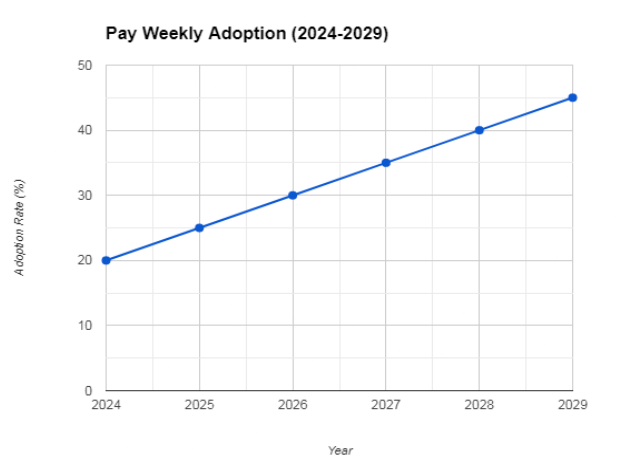

“Pay Weekly” Adoption (2024-2029)

- 2024: Around 20% of consumers are expected to use “pay weekly” options.

- 2025: This percentage is projected to grow to 25%.

- 2026-2027: Continued growth, reaching around 30-35% as more retailers and platforms integrate these payment methods.

- 2028-2029: By 2029, nearly 40-45% of consumers may use “pay weekly” options, driven by economic conditions and widespread retailer adoption.